Buying and owning your own home can have a big impact on your life. While there are financial reasons to become a homeowner, it's essential to think about the non-financial benefits that make a home more than just a place to live.

Here are some of the top non-financial reasons to buy a home.

According to Fannie Mae, 94% of survey respondents say “Having Control Over What You Do with Your Living Space” is a top reason to own.

Your home is truly your own space. If you own a home, unless there are specific homeowner association requirements, you can decorate and change it the way you like. That means you can make small changes or even do big renovations to make your home perfect for you. Your home is uniquely yours and by buying, you give yourself the freedom to tailor it to your individual style. Investopedia explains:

“One often-cited benefit of homeownership is the knowledge that you own your little corner of the world. You can customize your house, remodel, paint, and decorate without the need to get permission from a landlord.”

When you rent, you might not be able to make your place really feel like it’s yours. And if you do make any modifications, you might have to change them back before you leave. But if you own your home, you can make it just the way you want it. That level of customization can give you a sense of pride in where you live and make you feel more connected to it.

Fannie Mae also finds 90% say “Having a Good Place for Your Family To Raise Your Children” tops their list of why it’s better to buy a home.

Another important factor to think about is what stage of life you’re in. U.S. News breaks it down:

“For those with young children, buying a home and putting down roots is a major driver. . . . You don’t want the upheaval of a massive rent increase or a non-renewed lease to impact your sense of stability.”

No matter which of life’s milestones you’re in, stability and predictability are important. That’s because the one constant in life is that things will change. And, as life changes around you, having a familiar home and not worrying about moving regularly helps you and those who matter most feel more secure and more comfortable.

Lastly, Fannie Mae says 82% list “Feeling Engaged in Your Community” as another key motivator to own.

Owning your home also helps you feel even more connected to your neighborhood. People who own homes usually live in them for an average of nine years, according to the National Association of Realtors (NAR). As that time passes, it’s natural to make friends and build strong ties in the community. As Gary Acosta, CEO and Co-Founder at the National Association of Hispanic Real Estate Professionals (NAHREP), points out:

“Homeowners also tend to be more active in their local communities . . .”

When you care deeply about the people you live near, you’ll do what you can to contribute to your local area.

Owning your home can make your life better by giving you a sense of accomplishment, pride, stability, and connectedness. If you're thinking about becoming a homeowner and want to learn more, let’s connect. 870-425-4300.

The way Americans work has changed in recent years, and remote work is at the forefront of this shift. Experts say it’ll continue to be popular for years to come and project that 36.2 million Americans will be working remotely by 2025. To give you some perspective, that's a 417% increase compared to the pre-pandemic years when there were just 7 million remote workers.

If you’re in the market to buy a home and you work remotely either full or part-time, this trend is a game-changer. It can help you overcome some of today’s affordability and housing inventory challenges.

Remote or hybrid work allows you to change how you approach your home search. Since you’re no longer commuting every day, you may not feel it’s as essential to live near your office. If you’re willing to move a bit further out in the suburbs instead of the city, you could open up your pool of affordable options. In a recent study, Fannie Mae explains:

“Home affordability may also be a reason why we saw an increase in remote workers’ willingness to relocate or live farther away from their workplace . . .”

If you're thinking about moving, having this kind of location flexibility can boost your chances of finding a home that fits your budget. Work with your agent to cast a wider net that includes additional areas with a lower cost of living.

And as you broaden your search to include more affordable options, you may also find you have the chance to get more features for your money too. Given the low supply of homes for sale, finding a home that fits all your wants and needs can be challenging.

By opening up your search, you’ll give yourself a bigger pool of options to choose from, and that makes it easier to find a home that truly fits your lifestyle. This could include homes with more square footage, diverse home styles, and a wider range of neighborhood amenities that were previously out of reach.

Historically, living close to work was a sought-after perk, often coming with a hefty price tag. But now, the dynamics have changed. If you work from home, you have the freedom to choose where you want to live without the burden of long daily commutes. This shift allows you to focus more on finding a home that is affordable and delivers on your dream home features.

Remote work goes beyond job flexibility. It's a chance to broaden your horizons in your home search. Without being bound to a fixed location, you have the freedom to explore all of your options. Let’s connect to find out how this freedom can lead you to your ideal home. 870-425-4300

An important factor shaping today’s market is the number of homes for sale. And, if you’re considering whether or not to list your house, that’s one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, especially if it’s priced right.

But there are some early signs that more listings are coming. According to the latest data, new listings (homeowners who just put their house up for sale) are trending up. Here’s a look at why this is noteworthy and what it may mean for you.

It’s well known that the busiest time in the housing market each year is the spring buying season. That’s why there’s a predictable increase in the volume of newly listed homes throughout the first half of the year. Sellers are anticipating this and ramping up for the months when buyers are most active. But, as the school year kicks off and as the holidays approach, the market cools. It’s what’s expected.

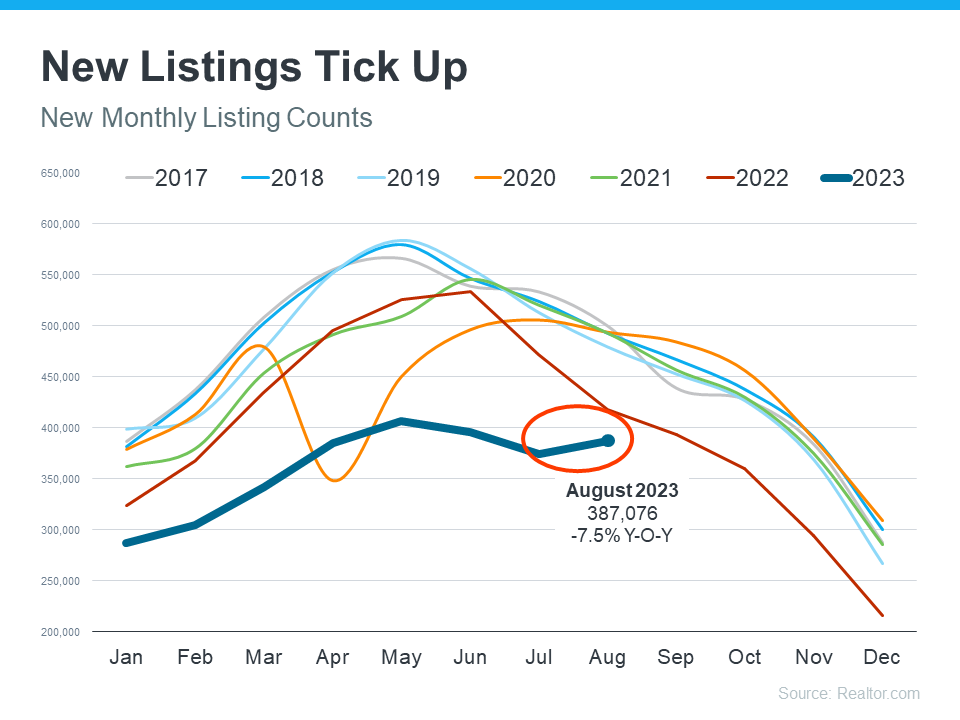

But here’s what’s surprising. Based on the latest data from Realtor.com, there’s an increase in the number of sellers listing their houses later this year than usual. A peak this late in the year isn’t typical. You can see both the normal seasonal trend and the unusual August in the graph below: As Realtor.com explains:

As Realtor.com explains:

“While inventory continues to be in short supply, August witnessed an unusual uptick in newly listed homes compared to July, hopefully signaling a return in seller activity heading toward the fall season . . .”

While this is only one month of data, it’s unusual enough to note. It’s still too early to say for sure if this trend will continue, but it’s something you’ll want to stay ahead of if it does.

If you’ve been putting off selling your house, now may be the sweet spot to make your move. That’s because, if this trend continues, you’ll have more competition the longer you wait. And if your neighbor puts their house up for sale too, it means you may have to share buyers’ attention with that other homeowner. If you sell now, you can beat your neighbors to the punch.

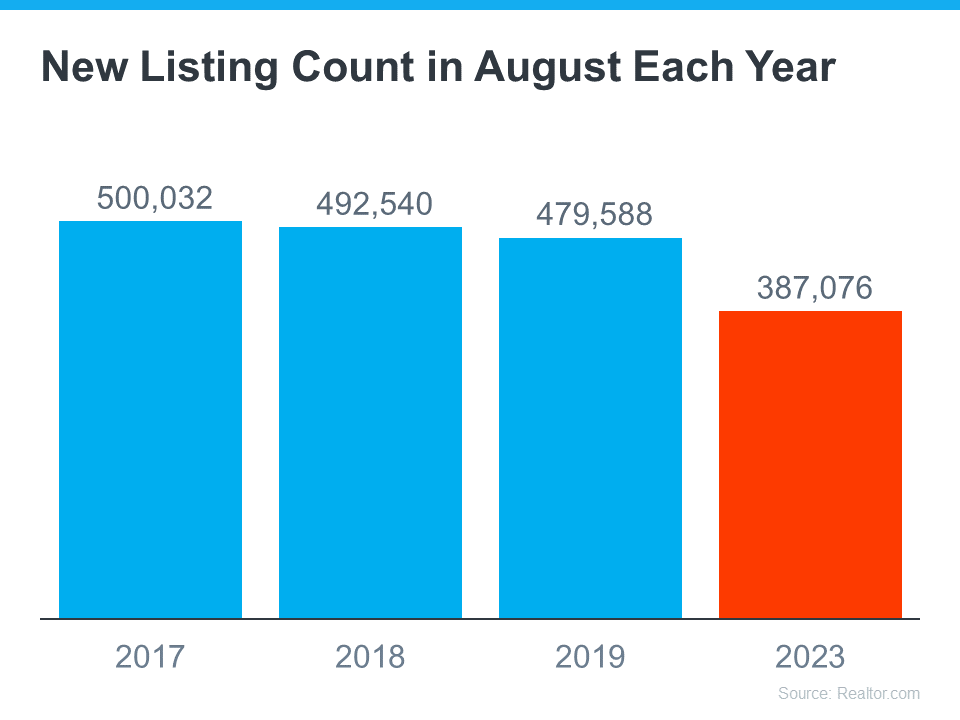

But, even with more homes coming onto the market, the market is still well below normal supply levels. And, that inventory deficit isn’t going to be reversed overnight. The graph below helps put this into context, so you can see the opportunity you still have now:

Even though inventory is still low, you don’t want to wait for more competition to pop up in your neighborhood. You still have an incredible opportunity if you sell your house today. Let’s connect to explore the benefits of selling now before more homes come to the market.

One question that’s top of mind if you’re thinking about making a move today is: Why is it so hard to find a house to buy? And while it may be tempting to wait it out until you have more options, that’s probably not the best strategy. Here’s why.

There aren’t enough homes available for sale, but that shortage isn’t just a today problem. It’s been a challenge for years. Let’s take a look at some of the long-term and short-term factors that have contributed to this limited supply.

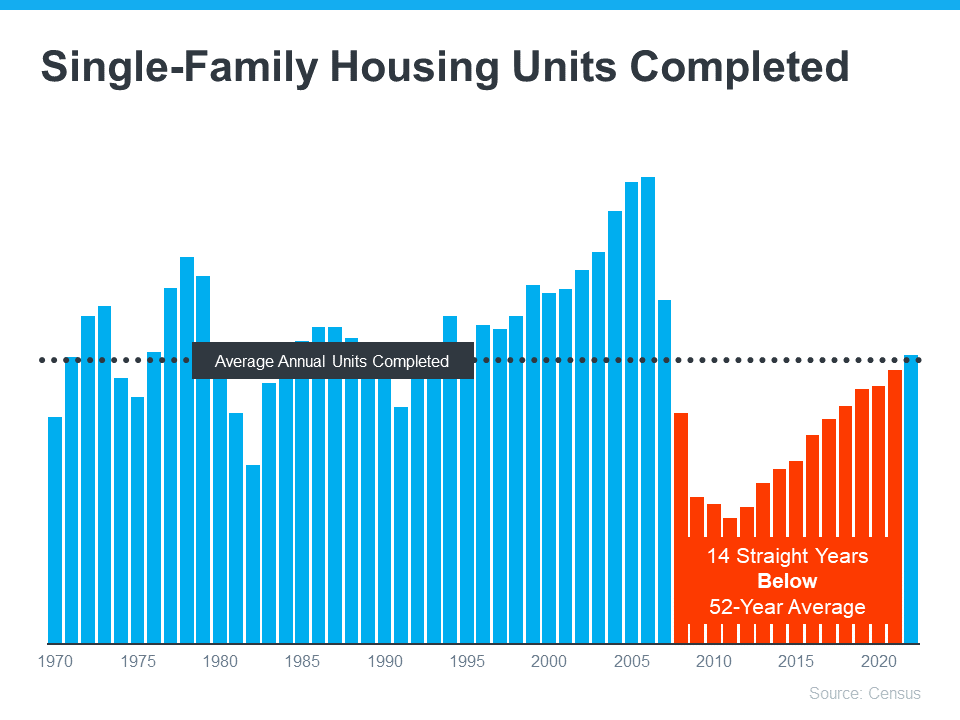

One of the big reasons inventory is low is because builders haven’t been building enough homes in recent years. The graph below shows new construction for single-family homes over the past five decades, including the long-term average for housing units completed:

For 14 straight years, builders didn’t construct enough homes to meet the historical average (shown in red). That underbuilding created a significant inventory deficit. And while new home construction is back on track and meeting the historical average right now, the long-term inventory problem isn’t going to be solved overnight.

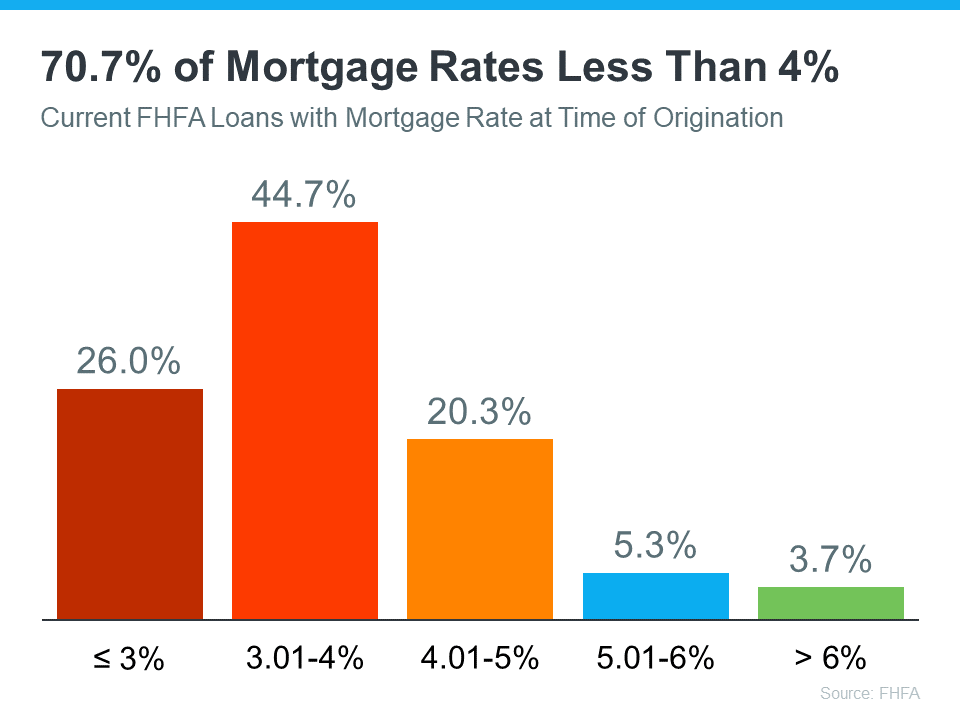

There are also a few factors at play in today’s market adding to the inventory challenge. The first is the mortgage rate lock-in effect. Basically, some homeowners are reluctant to sell because of where mortgage rates are right now. They don’t want to move and take on a rate that’s higher than the one they have on their current home. The chart below helps illustrate just how many homeowners may find themselves in this situation:

Those homeowners need to remember their needs may matter just as much as the financial aspects of their move.

Another thing that’s limiting inventory right now is the fear that’s been created by the media. You’ve likely seen the negative headlines calling for a housing crash, or the ones saying home prices would fall by 20%. While neither of those things happened, the stories may have dinged your confidence enough for you to think it’s better to hold off and wait for things to calm down. As Jason Lewris, Co-Founder and Chief Data Officer at Parcl, says:

“In the absence of trustworthy, up-to-date information, real estate decisions are increasingly being driven by fear, uncertainty, and doubt.”

That’s further limiting inventory because people who would make a move otherwise now feel hesitant to do so. But the market isn’t doom and gloom, even if the headlines are. An agent can help you separate fact from fiction.

If you’re wondering how today’s low inventory affects you, it depends on if you’re selling or buying a home, or both.

The low supply of homes for sale isn’t a new challenge. There are a number of long-term and short-term factors leading to the current inventory deficit. If you’re looking to make a move, let’s connect. That way you’ll have an expert on your side to explain how this impacts you and what’s happening with housing inventory in our area. 870-425-4300.

Are you a baby boomer who’s lived in your current house for a long time and you’re ready for a change? If you’re thinking about selling your house, you have a lot to consider. Will you move to a different state or stay nearby? Is it time to downsize or do you want more space to accommodate your loved ones? But maybe the biggest consideration boils down to this – will you buy your next home or choose to rent instead?

That decision ultimately depends on your current situation and your future plans. Here are two important factors to help you decide what’s right for you.

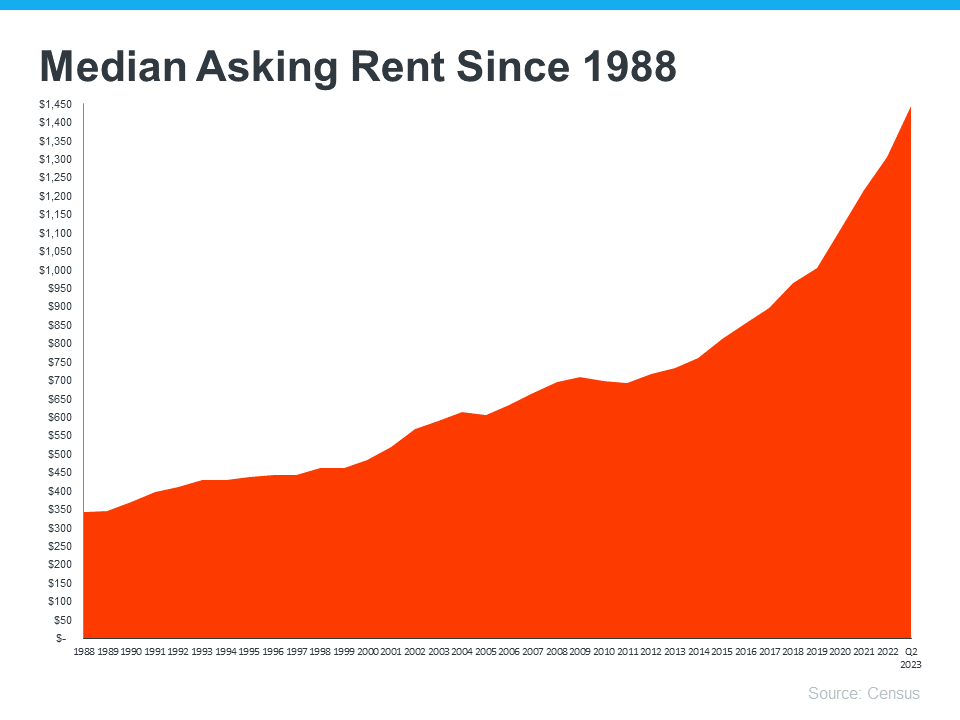

The graph below uses data from the Census to show how rents have been climbing steadily since 1988: Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

Rents have been going up consistently over the long run. If you choose to rent, there’s a risk your rental payment will go up each time you renew your lease. Having a higher rental expense may not be something you want to deal with every year.

When you buy a home with a fixed-rate mortgage, it helps stabilize your monthly housing payment. This allows you to lock in your monthly payment for the duration of your home loan. That keeps your payments steady and predictable for the long haul. Freddie Mac sums it up like this:

“. . . homeowners with fixed-rate loans will see little to no change to their monthly housing cost over the life of their loan. You can be confident in knowing that your mortgage payments won’t change much in the long term, even when life’s other costs do.”

According to AARP, buying your next home is a better long-term strategy than renting:

“Though each option has pros and cons, buying provides more pros, with a broader range of benefits.”

To help you choose what you’ll do after you sell, here are just a few of the benefits of homeownership that article covers:

If you're a baby boomer who’s wondering whether you should buy or rent your next home, let’s connect. With rents going up and homeownership providing so many benefits, it may make sense to consider buying your next home. 870-425-4300.

If you're planning to buy a home, one thing to consider is what experts project home prices will do in the future and how that might affect your investment. While you may have seen negative news over the past year about home prices, they’re doing far better than expected and are rising across the country. And data shows, experts forecast home prices will keep appreciating.

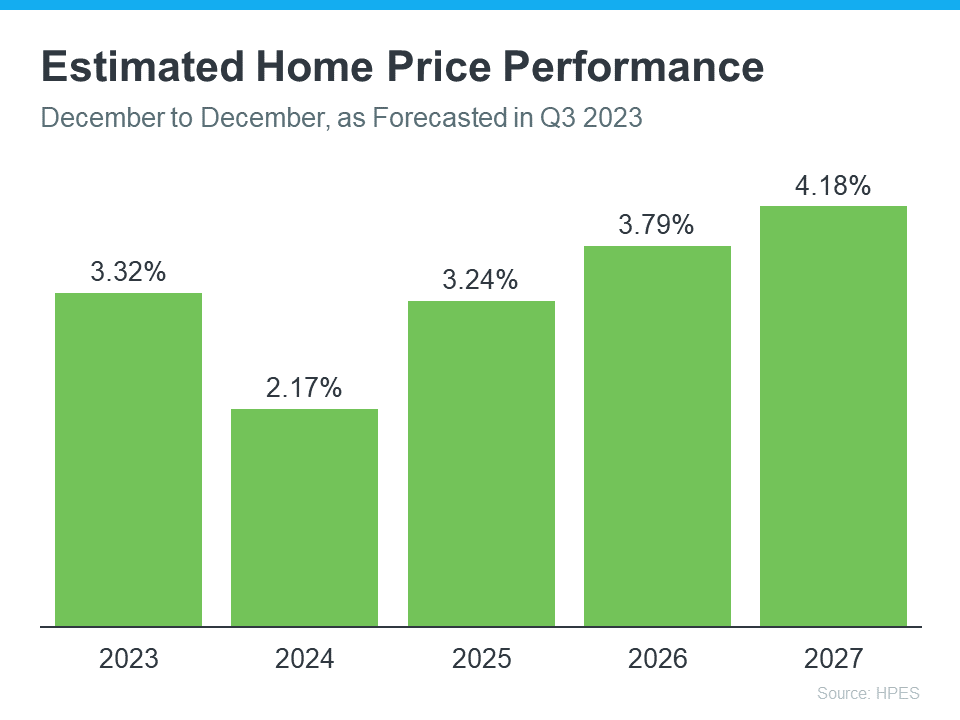

Pulsenomics polled over 100 economists, investment strategists, and housing market analysts in the latest quarterly Home Price Expectation Survey (HPES). The results show what the panelists project will happen with home prices over the next five years. Here are those expert forecasts saying home prices will go up every year through 2027 (see graph below): If you’re someone who was worried home prices would fall because of stories you’ve read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

If you’re someone who was worried home prices would fall because of stories you’ve read online, here's the big takeaway. Even though home prices vary by local market, experts project prices will continue to rise across the country for years to come. And these numbers indicate the return to more normal home price appreciation.

And while the projected increase in 2024 isn’t as large as 2023, it’s important to recognize home price appreciation is cumulative. In other words, if these experts are correct, after your home’s value rises by 3.32% this year, it’ll appreciate by another 2.17% next year. This is a good example of why owning a home is a choice that wins big over time.

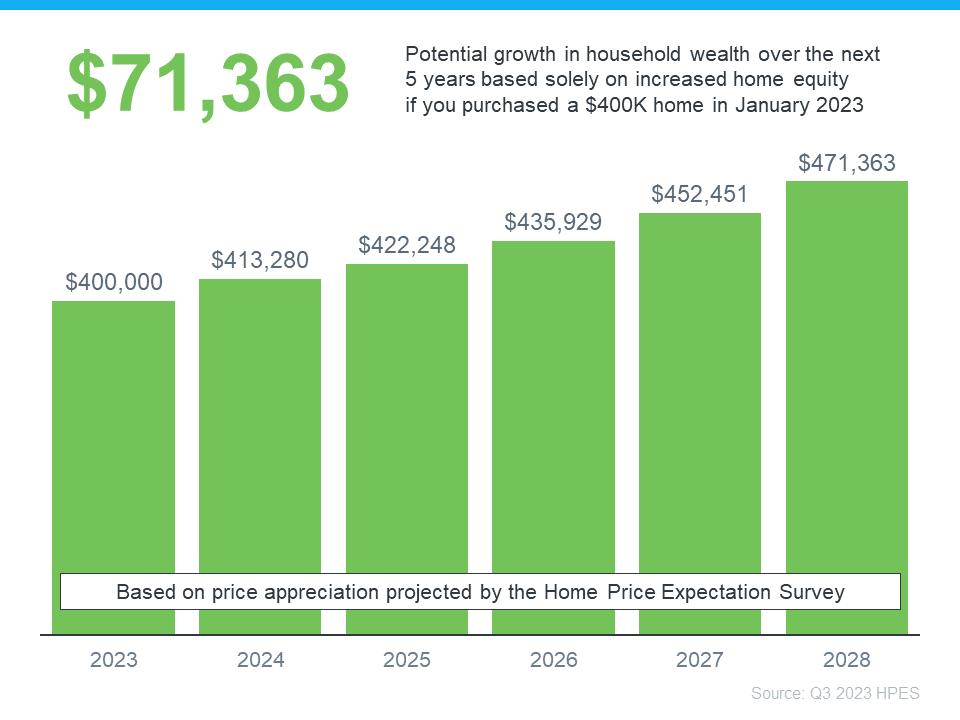

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth. To see how a typical home's value could change in the next few years using the expert projections from the HPES, check out the graph below: In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

In this example, let’s say you bought a $400,000 home at the beginning of this year. If you factor in the forecast from the HPES, you could potentially accumulate more than $71,000 in household wealth over the next five years.

So, if you're thinking about whether buying a home is a good choice, remember how it can be a powerful way to grow your wealth in the long run.

According to the experts, home prices are expected to grow over the next five years at a more normal pace. If you’re ready to become a homeowner, know that buying today can set you up for long-term success as home values (and your own net worth) grow. Let’s connect to start the homebuying process today. 870-425-4300

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

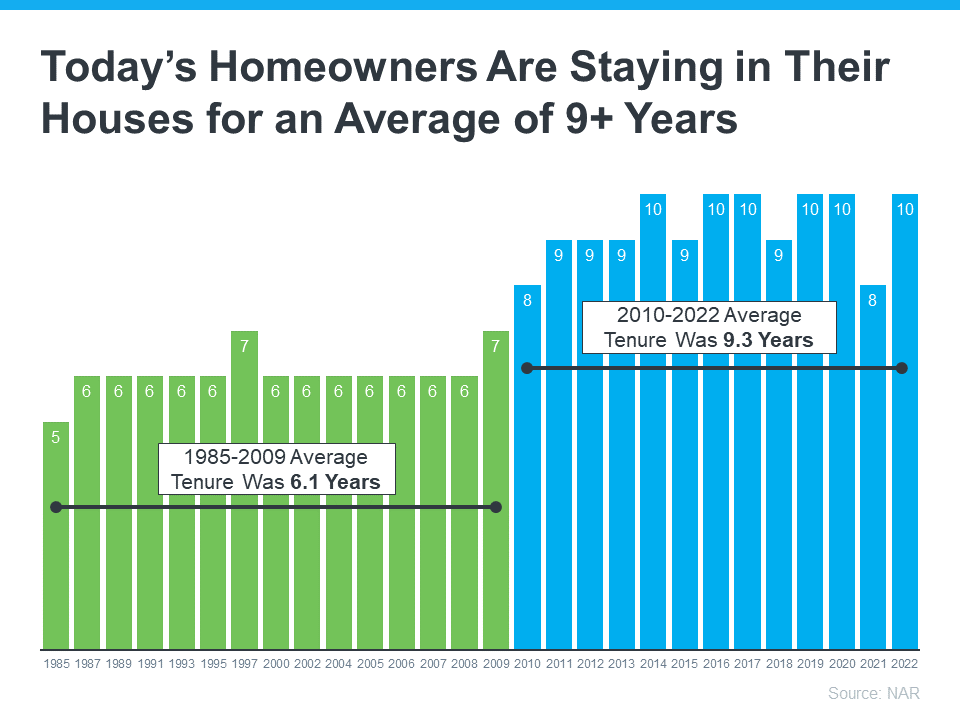

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

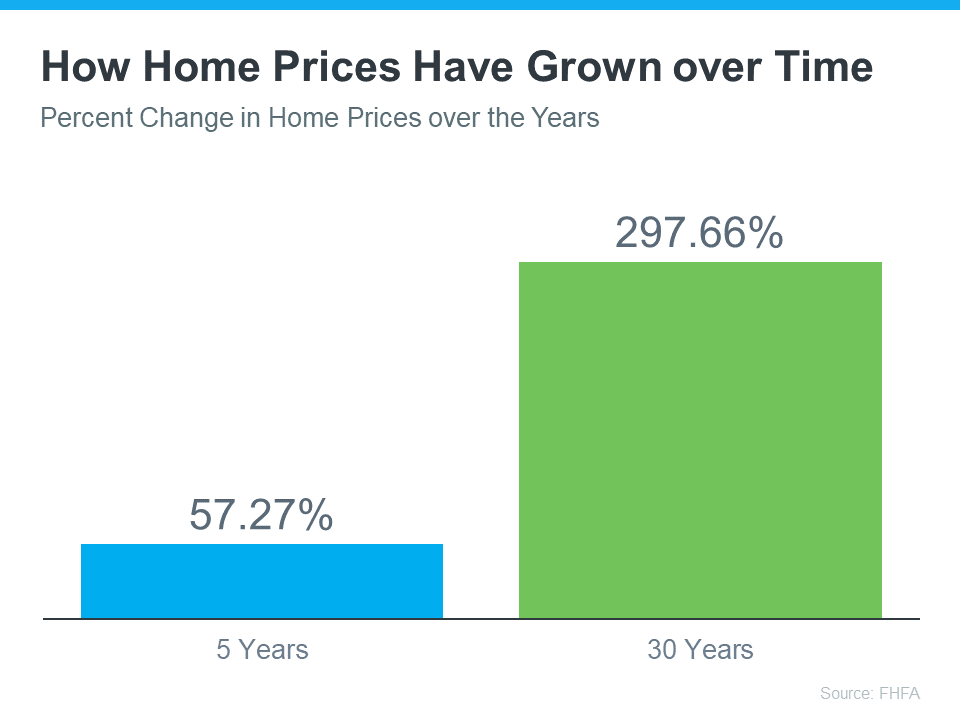

And, if you’ve been in your home for more than a few years, you’ve likely built-up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

As you plan for your retirement, let’s connect so we can find out how much equity you’ve built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs. 870-425-4300

Have you been trying to buy a home, but higher mortgage rates and home prices are limiting your options? If so, here’s some good news – based on what Ali Wolf, Chief Economist at Zonda, has to say – smaller, more affordable homes are on the way:

“Buyers should expect that over the next 12 to 24 months there will be a notable increase in the number of entry-level homes available.”

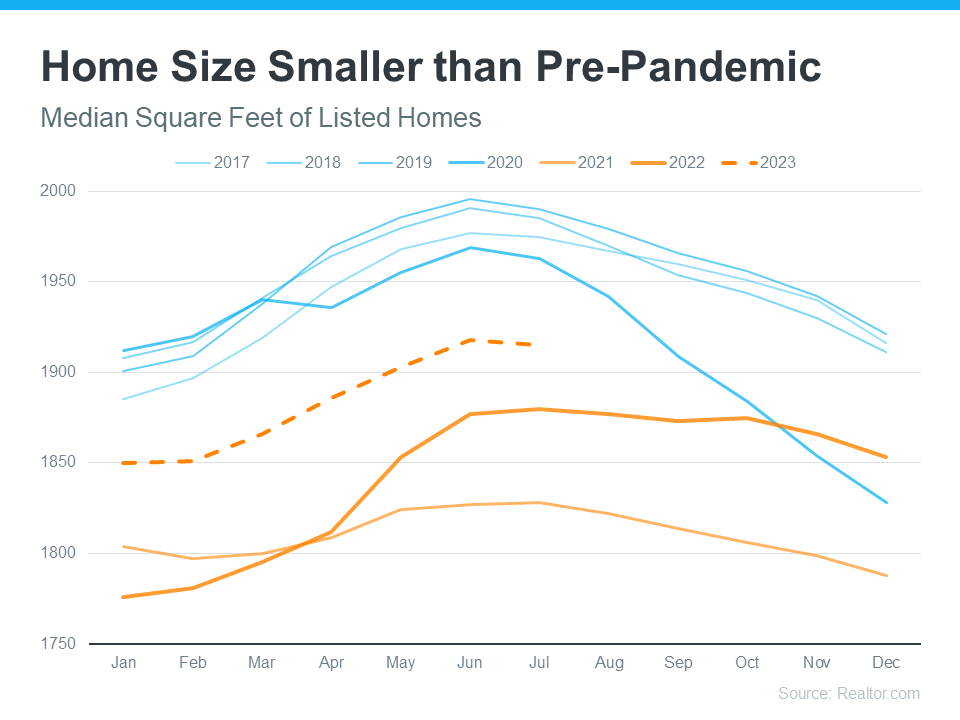

In some ways, smaller homes are already here. When the pandemic hit, the meaning of home changed. People needed the space their home provided not only as a place to live, but as a place to work, go to school, exercise, and more. Those who had that space were more likely to keep it. And those that didn’t were in a position where they were trying to sell their smaller house to move up to a larger one. That meant the homes coming to the market during the pandemic were smaller than those on the market before the pandemic – and that trend continues today (see graph below): This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

This graph also shows how the size of homes on the market changes seasonally. Larger homes tend to come on the market during the summer months when households with children who are out of school are looking to move.

That seasonality means, based on historical trends and the fact that fall is now approaching, we can expect smaller, more affordable homes to come to the market throughout the rest of the year.

That’s great news because, as Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), states, the need for these types of homes has gone up recently:

“. . . as interest rates increased in 2022, and housing affordability worsened, the demand for home size has trended lower.”

The seasonal trend of smaller homes coming to the market in the later months of the year, coupled with builders bringing smaller, more affordable newly built homes to the market right now, is good news – especially if you’re finding it difficult to afford a home. Mikaela Arroyo, Director of the New Home Trends Institute at John Burns Real Estate Consulting, says this about a potential increase in the availability of smaller homes:

“It’s not solving the affordability crisis, but it is creating opportunities for people to be able to afford an entry-level home in an area.”

If a smaller, more affordable home sounds appealing to you, good news – they’re coming. To keep up with what’s available in our area, let’s connect. 870-425-4300.

Toward the end of last year, there were a number of headlines saying home prices were going to fall substantially in 2023. That led to a lot of fear and questions about whether there was going to be a repeat of the housing crash that happened back in 2008. But the headlines got it wrong.

While there was a slight home price correction after the sky-high price appreciation during the ‘unicorn’ years, nationally, home prices didn’t come crashing down. If anything, prices were a lot more resilient than many people expected.

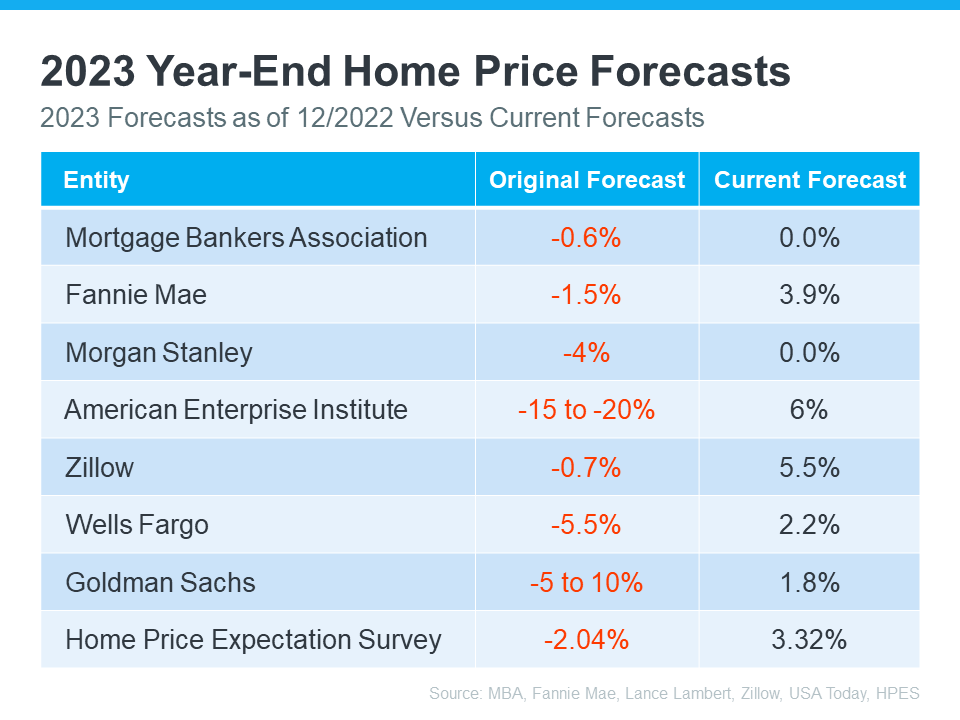

Let's take a look at some of the expert forecasts from late last year stacked against their most recent forecasts to show that even the experts recognize they were overly pessimistic.

This visual shows the 2023 home price forecasts from seven organizations. It provides the original 2023 forecasts (released in late 2022) for what would happen to home prices by the end of this year and their most recently revised 2023 forecasts (see chart below):

As the red in the middle column shows, in all instances, their original forecast called for home prices to fall. But, if you look at the right column, you’ll see all experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

As the red in the middle column shows, in all instances, their original forecast called for home prices to fall. But, if you look at the right column, you’ll see all experts have updated their projections for the year-end to show they expect prices to either be flat or have positive growth. That’s a significant change from the original negative numbers.

There are a number of reasons why home prices are so resilient to falling. As Odeta Kushi, Deputy Chief Economist at First American, says:

“One thing is for sure, having long-term, fixed-rate debt in the U.S. protects homeowners from payment shock, acts as an inflation hedge - your primary household expense doesn't change when inflation rises - and is a reason why home prices in the U.S. are downside sticky.”

For home prices, you’re going to continue to see misleading media coverage in the months ahead. That’s because there’s seasonality to home price appreciation and they’re going to misunderstand that. Here’s what you need to know to get ahead of the next round of negative headlines.

As activity in the housing market slows at the end of this year (as it typically does each year), home price growth will slow too. But, this doesn’t mean prices are falling – it’s just that they’re not increasing as quickly as they were when the market was in the peak homebuying season.

Basically, deceleration of appreciation is not the same thing as home prices depreciating.

The headlines have an impact, even if they’re not true. While the media said home prices would fall significantly in their coverage at the end of last year, that didn’t happen. Let’s connect so you have a trusted resource to help you separate fact from fiction with reliable data. 870-425-4300

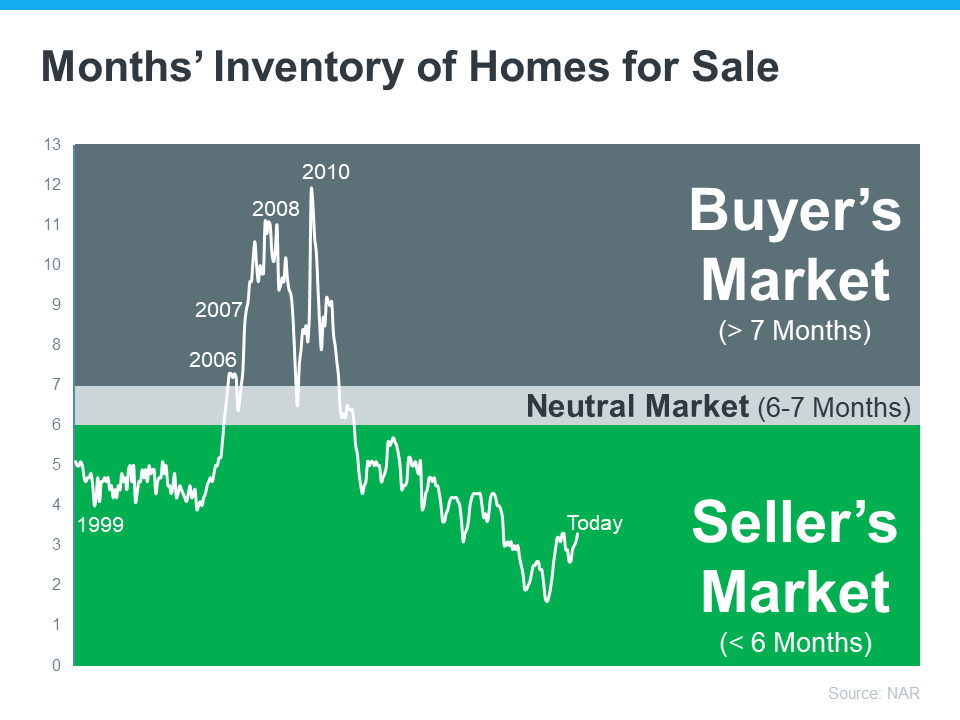

Even though activity in the housing market has slowed from the frenzy that was the ‘unicorn’ years, it’s still a seller’s market because the supply of homes for sale is so low. But what does that really mean for you? And why are conditions today so good if you want to sell your house?

The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Housing inventory is measured by the number of available homes on the market. It’s also measured by months’ supply, meaning the number of months it would take to sell all those available homes based on current demand. In a balanced market, there’s usually about a six-month supply. Today, we have only about 3 months’ supply of homes at the current sales pace (see graph below):

As the visual shows, given the current inventory of homes, it’s still a seller's market.

As the visual shows, given the current inventory of homes, it’s still a seller's market.

Today, we’re nowhere near what’s considered a balanced market. In fact, the current months’ supply is half of what’s typical of a normal market. That means there just aren’t enough homes to go around based on today’s buyer demand.

As Lawrence Yun, Chief Economist for NAR, says:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

Sellers, these conditions give you a real edge. Right now, there are buyers who are ready, willing, and able to purchase a home. And, because there's a shortage of homes up for sale, the ones that do hit the market are like magnets for those buyers.

If you work with a local real estate agent to list your house right now, in good condition, and at the right price, it could get a lot of attention. You might even end up with multiple offers.

Today’s seller’s market sets you up with a big advantage when you sell your house. Because supply is so low, your house will be in the spotlight for motivated buyers who are craving more options. Let’s connect so you understand what’s happening in our local area as you get ready to enter the market. 870-425-4300.