As we look back over the past year, we’ve certainly lived through one of the most stressful periods in recent history. After spending so much more time at home throughout the health crisis, some are wondering if they should move to improve their mental health and well-being. This is no surprise since the U.S. Census Bureau reported an increase in the percentage of adults with symptoms of anxiety and depression in a recent Household Pulse Survey.

There’s logic behind the idea that making a move could improve someone’s quality of life. When people change their scenery, they often feel happier. Catherine Hartley, an Assistant Professor at New York University’s Department of Psychology and co-author of a study on how new experiences impact happiness, mentioned:

“Our results suggest that people feel happier when they have more variety in their daily routines—when they go to novel places and have a wider array of experiences.”

If you’re looking for a new experience, planning a move into a new home may be something you’ve started to consider more carefully. If so, you’re not alone. The 2020 Annual National Movers Study by United Van Lines shows:

“For customers who cited COVID-19 as an influence on their move in 2020, the top reasons associated with COVID-19 were concerns for personal and family health and wellbeing (60%); desires to be closer to family (59%); 57% moved due to changes in employment status or work arrangement (including the ability to work remotely); and 53% desired a lifestyle change or improvement of quality of life.”

So, if you’re thinking of moving this year to help boost your happiness factor, here are a few questions to ask yourself as you make your decision.

Is the weather something that’s important to you? Does it have a tendency to impact your mood? The World Population Review shares:

“What states have the best weather? When evaluating each state for temperature, rain, and sun, some states stand out. Although climate and weather preferences are personal and subjective, some criteria are considered to make up the best weather, according to Current Results:

- Comfortable temperatures from 63°F to 86°F for more than half of the year.

- Dry weather with no more than 60 inches of rain per year.

- Mostly clear skies with an average of sunshine for at least 60% of the year.”

“Better weather” can mean different things to different people – some prefer the heat, others cooler temperatures, and some want to experience all four seasons. Think about what makes you feel happiest if you’re looking for a new location.

With the COVID-19 pandemic, some people are deciding to move to lower-density areas. Robert Dietz, Chief Economist at the National Association of Home Builders (NAHB), mentions:

“The third quarter Home Building Geography Index (HBGI) reveals that a suburban shift for consumer home buying preferences in the wake of the COVID-19 pandemic is accelerating as telecommuting is providing consumers more flexibility to live further out within large metros or even to relocate to more affordable, smaller metro areas.”

Can you work from home? Are you open to a longer commute in the future? If so, a move to the suburbs or even a quieter rural area may be a win for you. Or, if you’ve always dreamed of life in the city, now may be your chance to move into town.

As we look beyond the trials of the pandemic, many are hoping for a new beginning, and that may mean moving. Let’s connect today to talk about your new goals and options in today’s market. Give us a call at 870-425-4300 TODAY!

Historically low mortgage rates are a big motivator for homebuyers right now. In 2020 alone, rates hit new record-lows 16 times, and the trend continued into the early part of this year. Many hopeful homebuyers are now wondering if they should put their plans on hold and wait for the lowest rates imaginable. However, the reality is, acting sooner rather than later may be the actual win if you’re ready to buy a home.

According to Greg McBride, Chief Financial Analyst for Bankrate:

“As vaccines become more widely available and a return to normal starts to come into view, we’ll see mortgage rates bounce off the record lows.”

While only a slight increase in mortgage rates is projected for 2021, some experts believe they will start to rise. Over the past week, for example, the average mortgage rate ticked up slightly, reaching 2.79%. This is still incredibly low compared to the trends we’ve seen over time. According to Freddie Mac:

“Borrowers are smart to take advantage of these low rates now and will certainly benefit as a result.”

As mortgage rates rise, the increase impacts the overall cost of purchasing a home. The higher the rate, the higher your monthly mortgage payment, especially as home prices rise too. Sam Khater, Chief Economist at Freddie Mac, says:

“The forces behind the drop in rates have been shifting over the last few months and rates are poised to rise modestly this year. The combination of rising mortgage rates and increasing home prices will accelerate the decline in affordability and further squeeze potential homebuyers during the spring home sales season.”

Right now, the inventory of houses for sale is also at a historic low, making it more challenging than normal to find a home to buy in many areas. As more buyers hit the market in the typically busy spring buying season, it may become even harder to find a home in the coming months. With this in mind, Len Keifer, Deputy Chief Economist for Freddie Mac, recommends taking advantage of both low mortgage rates and the opportunity to buy:

“If you’ve found a home that fits your needs at a price you can afford, it might be better to act now rather than wait for future rate declines that may never come and a future that likely holds very tight inventory.”

While today’s low mortgage rates provide great opportunities for homebuyers, we may not see them stick around forever. If you’re ready to buy a home, let’s connect so you can take advantage of what today’s market has to offer.

According to the latest CoreLogic Home Price Insights Report, nationwide home values increased by 8.2% over the last twelve months. The dramatic rise was brought about as the inventory of homes for sale reached historic lows at the same time buyer demand was buoyed by record-low mortgage rates. As CoreLogic explained:

“Home price growth remained consistently elevated throughout 2020. Home sales for the year are expected to register above 2019 levels. Meanwhile, the availability of for-sale homes has dwindled as demand increased and coronavirus (COVID-19) outbreaks continued across the country, which delayed some sellers from putting their homes on the market.

While the pandemic left many in positions of financial insecurity, those who maintained employment and income stability are also incentivized to buy given the record-low mortgage rates available; this is increasing buyer demand while for-sale inventory is in short supply.”

Home price appreciation in 2021 will continue to be determined by this imbalance of supply and demand. If supply remains low and demand is high, prices will continue to increase.

According to the National Association of Realtors (NAR), the current number of single-family homes for sale is 1,080,000. At the same time last year, that number stood at 1,450,000. We are entering 2021 with approximately 270,000 fewer homes for sale than there were one year ago.

However, there is some speculation that the inventory crush will ease somewhat as we move through the new year for two reasons:

1. As the health crisis eases, more homeowners will be comfortable putting their houses on the market.

2. Some households impacted financially by the pandemic will be forced to sell.

Low mortgage rates have driven buyer demand over the last twelve months. According to Freddie Mac, rates stood at 3.72% at the beginning of 2020. Today, we’re starting 2021 with rates one full percentage point lower than that. Low rates create a great opportunity for homebuyers, which is one reason why demand is expected to remain high throughout the new year.

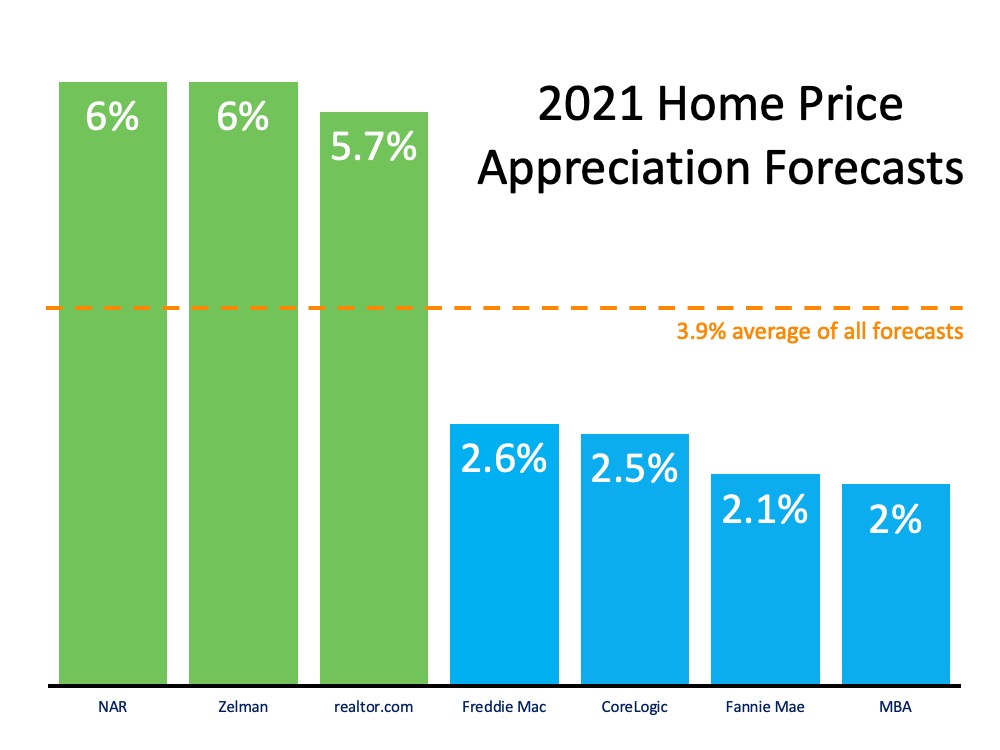

Taking into consideration these projections on housing supply and demand, real estate analysts forecast homes will continue to appreciate in 2021, but that appreciation may be at a steadier pace than last year. Here are their forecasts:

There’s still a very limited number of homes for sale for the great number of purchasers looking to buy them. As a result, the concept of “supply and demand” mandates that home values in the country will continue to appreciate.

The housing market recovery coming into the new year has been nothing short of remarkable. Many experts agree the turnaround from the nation’s economic pause is playing out extremely well for real estate, and the current market conditions are truly making this winter an ideal time to make a move. Here’s a dive into some of the biggest wins for homebuyers this season.

In 2020, mortgage rates hit all-time lows 16 times. Continued low rates have set buyers up for significant long-term gains. In fact, realtor.com notes:

“Given this means homes could cost potentially tens of thousands less over the lifetime of the loan.”

Essentially, it’s less expensive to borrow money for a home loan today than it has been in years past. Although mortgage rates are expected to remain relatively low in 2021, even the slightest increase can make a big difference in your payments over the lifetime of a home loan. So, this is a huge opportunity to capitalize on right now before mortgage rates start to rise.

According to John Burns Consulting, 58.7% of homes in the U.S. have at least 60% equity, and 42.1% of all homes in this country are mortgage-free, meaning they’re owned free and clear.

In addition, CoreLogic notes the average equity homeowners gained since last year is $17,000. That’s a tremendous amount of forced savings for homeowners, and an opportunity to use this increasing equity to make a move into a home that fits your changing needs this season.

According to leading experts, home prices are forecasted to continue appreciating. Today, many experts are projecting more moderate home price growth than last year, but still moving in an upward direction through 2021.

Knowing home values are increasing while mortgage rates are so low should help you feel confident that buying a home before prices rise even higher is a strong long-term investment.

With today’s low inventory of homes on the market, which is contributing to this home price appreciation, sellers are in the driver’s seat. The competition is high among buyers, so homes are selling quickly.

Making a move while so many buyers are looking for homes to purchase may mean your house rises to the top of the buyer pool. Selling your house before more listings come to the market in the traditionally busy spring market might be your best chance to shine.

If you’re considering making a move, this may be your moment, especially with today’s low mortgage rates and limited inventory. Let’s connect to get you set up for homebuying success in the new year.