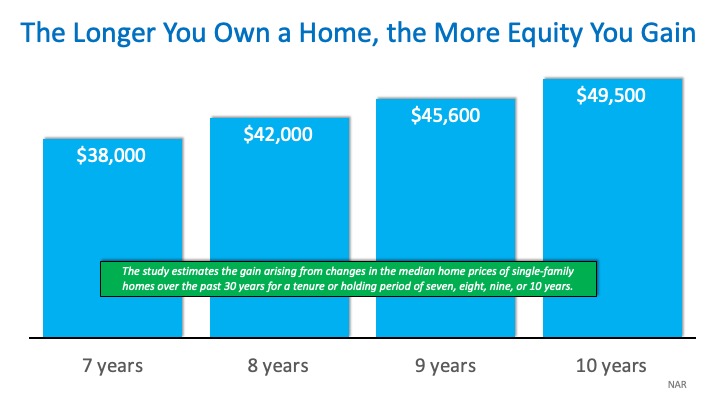

Earlier this month, the National Association of Realtors (NAR) released a special study titled Single-Family Home Price Gains by Years of Tenure. The study estimates median home price appreciation over the last 30 years based on the length of homeownership.

Below are three graphs depicting the most important data revealed in the study.

One of the first measures of the financial benefits of homeownership is the net worth (in the form of equity) an owner can build over time. The study showed the average increase in home values based on how long homeowners stayed in a home.

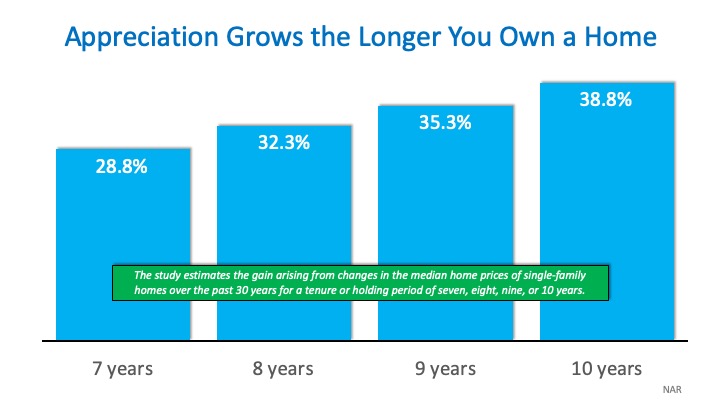

Another way to look at this is by the percentage increase in value over time, called appreciation:

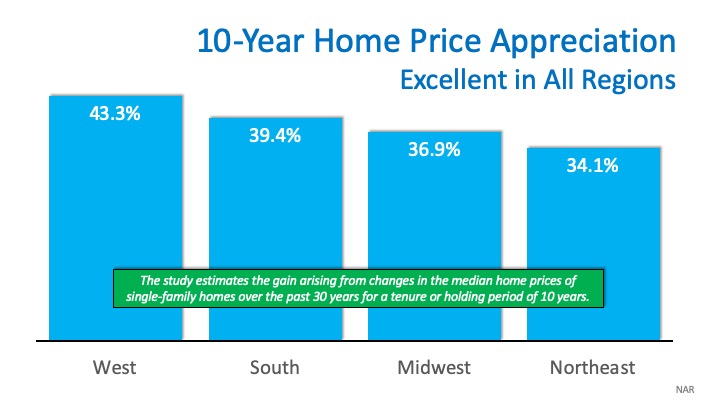

Today, when we think of markets that have done well over the last decade, we have a tendency to think about San Francisco, San Diego, Seattle, and other West Coast cities. Though it is true the West Region showed the highest price growth over the last three decades, we can see how every region of the country did quite well in ten-year increments: This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

This data validates the claim that homeownership is great for building wealth. The importance of this information was highlighted in the study’s first sentence:

“Homeownership is an important source of wealth creation, enabling current homeowners and succeeding generations to move up the economic ladder.”

Homeownership has many financial and non-financial benefits. The accumulation of “housing wealth” through increased equity is a major one. If you’re thinking of buying a home for the first time or moving up to your dream home, the sooner you make the move, the sooner your net worth will begin to grow.

The gap between the increase in personal income and residential real estate prices has been used to defend the concept that we are experiencing an affordability crisis in housing today.

It is true that home prices and wages are two key elements in any affordability equation. There is, however, an extremely important third component to that equation: mortgage interest rates.

Mortgage interest rates have fallen by more than a full percentage point from this time last year. Today’s rate is 3.75%; it was 4.86% at this time last year. This has dramatically increased a purchaser’s ability to afford a home.

Here are three reports validating that purchasing a home is in fact more affordable today than it was a year ago:

CoreLogic’s Typical Mortgage Payment

“Falling mortgage rates and slower home-price growth mean that many buyers this year are committing to lower mortgage payments than they would have faced for the same home last year. After rising at a double-digit annual pace in 2018, the principal-and-interest payment on the nation’s median-priced home – what we call the “typical mortgage payment”– fell year-over-year again.”

The National Association of Realtors’ Affordability Index

“At the national level, housing affordability is up from last month and up from a year ago…All four regions saw an increase in affordability from a year ago…Payment as a percentage of income was down from a year ago.”

First American’s Real House Price Index (RHPI)

“In 2019, the dynamic duo of lower mortgage rates and rising incomes overcame the negative impact of rising house price appreciation on affordability. Indeed, affordability reached its highest point since January 2018. Focusing on nominal house price changes alone as an indication of changing affordability, or even the relationship between nominal house price growth and income growth, overlooks what matters more to potential buyers – surging house-buying power driven by the dynamic duo of mortgage rates and income growth. And, we all know from experience, you buy what you can afford to pay per month.”

Though the price of homes may still be rising, the cost of purchasing a home is actually falling. If you’re thinking of buying your first home or moving up to your dream home, let’s connect so you can better understand the difference between the two.

When the number of buyers in the housing market outnumbers the number of homes for sale, it’s called a “seller’s market.” The advantage tips toward the seller as low inventory heats up the competition among those searching for a place to call their own. This can create multiple offer scenarios and bidding wars, making it tough for buyers to land their dream homes – unless they stand out from the crowd. Here are three reasons why pre-approval should be your first step in the homebuying process.

Low inventory, like we have today, means homebuyers need every advantage they can get to make a strong impression and close the deal. One of the best ways to get one step ahead of other buyers is to get pre-approved for a mortgage before you make an offer. For one, it shows the sellers you’re serious about buying a home, which is always a plus in your corner.

Pre-approval can also speed up the homebuying process, so you can move faster when you’re ready to make an offer. In a competitive arena like we have today, being ready to put your best foot forward when the time comes may be the leg-up you need to cross the finish line first and land the home of your dreams.

Here’s the other thing: if you’re pre-approved, you also have a better sense of your budget, what you can afford, and ultimately how much you’re eligible to borrow for your mortgage. This way, you’re less apt to fall in love with a home that may be out of your reach.

Freddie Mac sets out the advantages of pre-approval in the My Home section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

Local real estate professionals also have relationships with lenders who can help you through this process, so partnering with a trusted advisor will be key for that introduction. Once you select a lender, you’ll need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac also describes the ‘4 Cs’ that help determine the amount you’ll be qualified to borrow:

While there are still many additional steps you’ll need to take in the homebuying process, it’s clear why pre-approval is always the best place to begin. It’s your chance to gain the competitive edge you may need if you’re serious about owning a home.

Getting started with pre-approval is a great way to begin the homebuying journey. Let’s get together today to make sure you’re on the fastest path to homeownership.

In the spring, many excited buyers get ready to enter the housing market. Others continue dreaming about the homes they’d like to buy. The truth is, many potential buyers continue to dream longer than they need to, simply because they’re confused about the homebuying process. Thankfully, working with a trusted real estate professional can help ease those concerns and make the process to homeownership much easier to understand.

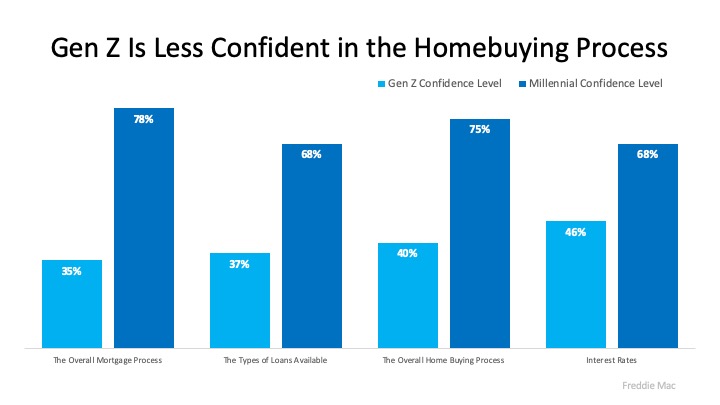

A recent survey conducted by Ipson and Freddie Mac reveals the confidence level of Gen Z and Millennial buyers regarding the homebuying process. The graph below shows the breakdown of the top results, clearly indicating there’s a significant portion of younger buyers who are not yet confident with some of the steps in the homebuying process.

Between the homebuying process and the mortgage process, there are 230

Between the homebuying process and the mortgage process, there are 230

There are many reasons why these steps can change as you move through each one. Depending on your personal circumstances, the term or your mortgage, and the type of loan you use, the path you take may need to vary. That’s why guidance and support from the experts is key.

In addition to the process itself, respondents in the survey definitely expressed concerns about understanding the types of loans available. Here are just a few of the basic loans to consider. Be sure to speak with your lender about the specifics of what will work best for you:

Interest rates also popped up as a common area of confusion among Gen Z and Millennial respondents in the survey. With today’s rates hovering at near historic lows, it’s a fantastic time for buyers to get more house for their money in the current market. Why? When mortgage rates are this low and wages are increasing as they are today, overall affordability increases, enabling home buyers to stretch their mortgage dollars further. It’s just another area where a trusted professional can help simplify the process and give guidance along the way.

There are many possible steps in a real estate transaction, but they don’t have to be confusing. To understand your best course of action, let’s get together today to ensure you have a trusted advisor who will help you feel confident and informed at every turn. Call today! 870-425-4300.

There are many clear financial benefits to owning a home: increasing equity, building net worth, growing appreciation, and more. If you’re a renter, it’s never too early to make a plan for how homeownership can propel you toward a stronger future. Here’s a dive into three often-overlooked financial benefits of homeownership and how preparing for them now can steer you in the direction of greater stability, savings, and predictability.

“If you’ve been a lifelong renter, this may sound like a foreign concept, but believe it or not, one day you won’t have a monthly housing payment. Unlike renting, you will eventually pay off your mortgage and your monthly payments will be funding other (possibly more fun) things.”As a homeowner, someday you can eliminate the monthly payment you make on your house. That’s a huge win and a big factor in how homeownership can drive stability and savings in your life. As soon as you buy a home, your monthly housing costs will begin to work for you as forced savings, coming in the form of equity. As you build equity and grow your net worth, you can continue to reinvest those savings into your future, maybe even by buying that next dream home. The possibilities are truly endless.

“Both the interest and property tax portion of your mortgage is a tax deduction. As long as the balance of your mortgage is less than the total price of your home, the interest is 100% deductible on your tax return.”Whether you’re living in your first home or your fifth, it’s a huge financial advantage to have some tax relief tied to the interest you pay each year. It’s one thing you definitely don’t get when you’re renting. Be sure to work with a tax professional to get the best possible benefits on your annual return.

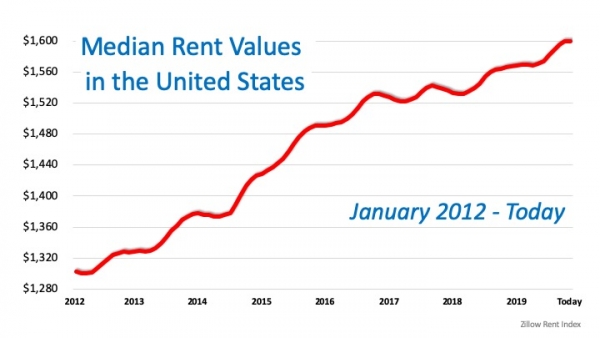

“As a homeowner, your monthly costs are most likely based on a fixed-rate mortgage, which allows you to budget your finances over a long period of time, unlike the unpredictability of renting.”With a mortgage, you can keep your monthly housing costs steady and predictable. Rental prices have been skyrocketing since 2012, and with today’s low mortgage rates, it’s a great time to get more for your money when purchasing a home. If you want to lock-in your monthly payment at a low rate and have a solid understanding of what you’re going to spend in your mortgage payment each month, buying a home may be your best bet.

The success of the U.S. residential real estate market, like any other market, is determined by supply and demand. This means we need to look at how many potential purchasers are in the market versus the number of houses that are available to buy. With early 2020 housing data now rolling in, it’s quite evident there are two big stories impacting this year’s residential real estate market:

1. Buyer demand is already extremely strong

2. Housing supply is at a historically low level

ShowingTime is a firm that compiles data from property showings scheduled across the country. The latest ShowingTime Showing Index reveals how showings have increased in each of the country’s four regions for five months in a row.

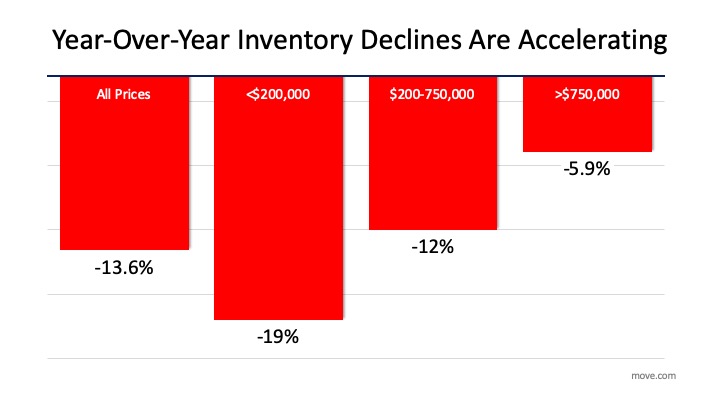

Move.com also just released information indicating that the number of homes currently for sale has declined rapidly and now sits at the lowest level in almost a decade. They explained,

“National housing inventory declined 13.6 percent in January, the steepest year-over-year decrease in more than 4 years, pushing the supply of for sale homes in the U.S. to its lowest level since realtor.com began tracking the data in 2012.”

In response to these numbers, Danielle Hale, Chief Economist at realtor.com, said,

“Homebuyers took advantage of low mortgage rates and stable listing prices to drive sales higher at the end of 2019, further depleting the already limited inventory of homes for sale. With fewer homes coming up for sale, we’ve hit another new low of for sale-listings in January.”

The decrease in inventory impacted every price range, too. Here’s a graph showing the data released by move.com:

Since there’s a historic shortage of homes for sale, putting your home on the market today could drive an excellent price and give you additional negotiating leverage when selling your house. Let’s get together to determine if listing your house now is your best move. Call any one of our agents to schedule a listing appointment. Or, give us a call to get your questions answered before you list. 870-425-4300.

Even though there’s a big buyer demand for homes in today’s low inventory market, it doesn’t mean you should price your home as high as the sky when you’re ready to sell. Here’s why making sure you price it right is key to driving the best price for the sale.

If you’ve ever watched the show “The Price Is Right,” you know the only way to win the game is to be the one to correctly guess the price of the item up for bid without going over. That means your guess must be just slightly under the retail price.

When it comes to pricing your home, setting it at or slightly below market value will increase the visibility of your listing and drive more buyers your way. This strategy actually increases the number of buyers who will see your home in their search process. Why? When potential buyers look at your listing and see a great price for a fantastic home, they’re probably going to want to take a closer look. This means more buyers are going to be excited about your house and more apt to make an offer.

When this happens, you’re more likely to set up a scenario with multiple offers, potential bidding wars, and the ability to drive a higher final sale price. At the end of the day, even when inventory is tight, pricing it right – or pricing it to sell immediately – makes a big difference.

Here’s the other thing: homeowners who make the mistake of overpricing their homes will eventually have to lower the prices anyway after they sit on the market for an extended period of time. This leaves buyers wondering if the price drops were caused by something wrong with these homes when in reality, nothing was wrong, the initial prices were just too high.

If you’re thinking about selling your home this year, let’s get together so you have a professional on your side to help you properly price your home and maximize demand from the start.

Rents in the United States have been skyrocketing since 2012. This has caused many renters to face a tremendous burden when juggling their housing expenses and the desire to save for a down payment at the same time. The recent stabilization of rental prices provides a great opportunity for renters to save more of their current income to put toward the purchase of a home.

Just last week the Joint Center of Housing Studies of Harvard University released the America’s Rental Housing 2020 Report. The results explain the financial challenges renters are experiencing today,

“Despite slowing demand and the continued strength of new construction, rental markets in the U.S. remain extremely tight. Vacancy rates are at decades-long lows, pushing up rents far faster than incomes. Both the number and share of cost-burdened renters are again on the rise, especially among middle-income households.”

According to the most recent Zillow Rent Index, which measures the estimated market-rate rent for all homes and apartments, the typical U.S. rent now stands at $1,600 per month. Here is a graph of how the index’s median rent values have climbed over the last eight years:

There seems, however, to be some good news on the horizon. Four of the major rent indices are all reporting that rents are finally beginning to stabilize in all rental categories:

1. The Zillow Rent Index, linked above, only rose 2.6% over the last year.

2. RENTCafé’s research team also analyzes rent data across the 260 largest cities in the United States. The data on average rents comes directly from competitively rented, large-scale, multi-family properties (50+ units in size). Their 2019 Year-End Rent Report shows only a 3% increase in rents from last year, the slowest annual rise over the past 17 months.

3. The CoreLogic Single Family Rent Index reports on single-family only rental listing data in the Multiple Listing Service. Their latest index shows how overall year-over-year rent price increases have slowed since February 2016, when they peaked at 4.2%. They have stabilized around 3% since early 2019.

4. The Apartment List National Rent Report uses median rent statistics for recent movers taken from the Census Bureau American Community Survey. The 2020 report reveals that the year-over-year growth rate of 1.6% matches the rate at this time last year; it is just ahead of the 1.5% rate from January 2016. They also explain how “the past five years also saw stretches of notably faster rent growth. Year-over-year rent growth stood at 2.6% in January 2018, and in January 2016 it was 3.3%, more than double the current rate.”

It seems tenants are getting a breather from the rapid rent increases that have plagued them for almost a decade.

Rental expenses are beginning to moderate, and at the same time, average wages are increasing. That power combination may allow renters who dream of buying a home of their own an opportunity to save more money to put toward a down payment. That’s sensational news! Give Peglar Real Estate Group a call today 870-425-4300

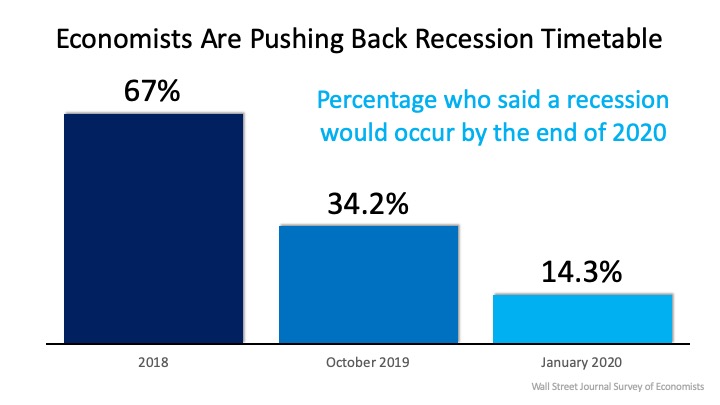

We’re currently in the longest economic recovery in U.S. history. That has caused some to ask experts to project when the next economic slowdown (recession) could occur. Two years ago, 67% of the economists surveyed by the Wall Street Journal (WSJ) for the Economic Forecasting Survey predicted we would have a recession no later than the end of this year (2020). The same study done just three months ago showed more than one third of the economists still saw an economic slowdown right around the corner.

The news caused concern among consumers. This is evidenced by a recent survey done by realtor.com that shows 53% of home purchasers (first-time and repeat buyers) currently in the market believe a recession will occur by the end of this year.

Now, in an article earlier this month, the Wall Street Journal (WSJ) revealed only 14.3% of those economists now believe we’re in danger of a recession occurring this year (see graph below): The WSJ article strongly stated,

The WSJ article strongly stated,

“The U.S. expansion, now in its 11th year, will continue through the 2020 presidential election with a healthy labor market backing it up, economists say.”

This optimism regarding the economy was repeated by others as well.

CNBC, quoting Goldman Sachs economists:

“Just months after almost everyone on Wall Street worried that a recession was just around the corner, Goldman Sachs said a downturn is unlikely over the next several years. In fact, the firm’s economists stopped just short of saying that the U.S. economy is recession-proof.”

“When Barron’s gathers some of Wall Street’s best minds—as we do every January for our annual Roundtable—we expect some consensus, some disagreement…But the 10 veteran investors and economists who convened in New York on Jan. 6 at the Barron’s offices agree that there’s almost no chance of a recession this year.”

“The U.S. economy is heading into 2020 at a pace of steady, sustained growth after a series of interest rate cuts and the apparent resolution of two trade-related threats mostly eliminated the risk of a recession.”

Robert A. Dye, Chief Economist at Comerica Bank:

“I expect that the U.S. economy will avoid a recession in 2020.”

There probably won’t be a recession this year. That’s good news for you, whether you’re looking to buy or sell a home. Give any one of our agents a call at 870-425-4300 to schedule an appointment. We'd love to talk to you more about this topic.

If you’re following what’s happening in the current housing market, you’ve seen how the lack of newly constructed homes is a major reason there’s a shortage of housing inventory available to today’s buyers. Another reason is that the inventory of existing homes for sale is shrinking. According to the most recent Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 10.8% from the same time last year. That exceeds expectations and is great news.

The troubling news from the report is that the sold inventory is not being replaced. As NAR explained,

“Total housing inventory at the end of December totaled 1.40 million units, down 14.6% from November and 8.5% from one year ago. Unsold inventory sits at a 3.0-month supply at the current sales pace, down from the 3.7-month figure recorded in both November and December 2018. Unsold inventory totals have dropped for seven consecutive months from year-ago levels, taking a toll on home sales.”

The situation was also addressed in a recent Zillow article stating,

“The number of for-sale homes in the U.S. is at its lowest point in at least seven years, and the shortage appears poised to get worse before it gets better.”

Bill McBride of Calculated Risk further noted,

“Inventory always decreases sharply in December as people take their homes off the market for the holidays. However, based on the data I’ve collected, this was the lowest level for inventory in at least three decades (the previous low was 1.43 million in December 1993).”

A year ago, that was the case – but the market shifted again. Skylar Olsen, Director of Economic Research at Zillow, explains,

“A year ago, a combination of a government shutdown, stock market slump and mortgage rate spike caused a long-anticipated inventory rise. That supposed boom turned out to be a short-lived mirage as buyers came back into the market and more than erased the inventory gains. As a natural reaction, the recent slowdown in home values looks like it’s set to reverse back to accelerating growth right as we head into home shopping season with demand outpacing supply.”

Now is a great time to consider putting your home on the market. The competition (number of houses on the market) has not been this low in decades. It’s best not to wait for the inventory (both existing homes and new construction) to increase in the spring, as it always does.

The supply of homes for sale is at a historic low. Buyer demand is surprisingly strong. Now would be a great time to sell.

If you’re following what’s happening in the current housing market, you’ve seen how the lack of newly constructed homes is a major reason there’s a shortage of housing inventory available to today’s buyers. Another reason is that the inventory of existing homes for sale is shrinking. According to the most recent Existing Home Sales Report from the National Association of Realtors (NAR), sales are up 10.8% from the same time last year. That exceeds expectations and is great news.

The troubling news from the report is that the sold inventory is not being replaced. As NAR explained,

“Total housing inventory at the end of December totaled 1.40 million units, down 14.6% from November and 8.5% from one year ago. Unsold inventory sits at a 3.0-month supply at the current sales pace, down from the 3.7-month figure recorded in both November and December 2018. Unsold inventory totals have dropped for seven consecutive months from year-ago levels, taking a toll on home sales.”

The situation was also addressed in a recent Zillow article stating,

“The number of for-sale homes in the U.S. is at its lowest point in at least seven years, and the shortage appears poised to get worse before it gets better.”

Bill McBride of Calculated Risk further noted,

“Inventory always decreases sharply in December as people take their homes off the market for the holidays. However, based on the data I’ve collected, this was the lowest level for inventory in at least three decades (the previous low was 1.43 million in December 1993).”

A year ago, that was the case – but the market shifted again. Skylar Olsen, Director of Economic Research at Zillow, explains,

“A year ago, a combination of a government shutdown, stock market slump and mortgage rate spike caused a long-anticipated inventory rise. That supposed boom turned out to be a short-lived mirage as buyers came back into the market and more than erased the inventory gains. As a natural reaction, the recent slowdown in home values looks like it’s set to reverse back to accelerating growth right as we head into home shopping season with demand outpacing supply.”

Now is a great time to consider putting your home on the market. The competition (number of houses on the market) has not been this low in decades. It’s best not to wait for the inventory (both existing homes and new construction) to increase in the spring, as it always does.

The supply of homes for sale is at a historic low. Buyer demand is surprisingly strong. Now would be a great time to sell. Give Peglar Real Estate a call today! 870-425-4300